In last few years you might have experienced your ATO correspondences suddenly dropping into your myGov account, or posted to you, instead to us as your accountants. This has been an ongoing issue with ATO's communication processes for some time now. We certainly have been facing instances where BAS or IAS forms would suddenly stop coming to our office, causing us to chase ATO and check where the ball has dropped.

Fortunately ATO has now introduced a service known as 'Communication Preferences' which should hopefully resolve this issue. Broadly, these communication preferences relate to the following six communication types;

- income tax

- superannuation

- activity statement related

- study and training loans

- debt

- employer and business obligations

Unfortunately though, every new step from ATO brings with it a level of red tape.

What does this mean to you?

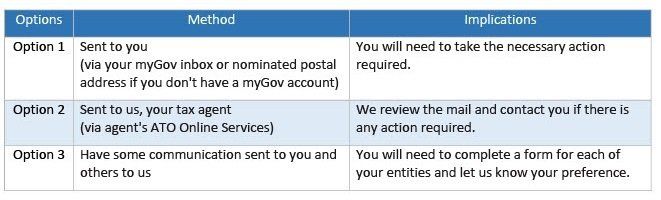

You can now choose where the ATO sends your communications. Your options are;

Red Tape : We need to record your preferences in writing and update ATO.

How can we make it easy for you.

Alongside above, there are other industry and legal changes requiring us to update our engagement letters for all our clients. In the next few months you will receive our updated engagement letter. As part of your acceptance, we will update ATO with a default setting of Option 2.

Alternatively, if you wish to action this immediately, or wish to choose Option 1 or Option 3, please click here to complete an online form.

Join MGAA's Community