Economic times are changing rapidly. Covid-19 is hitting all industries. The worst impacted being tourism, food services, taxi and UBER drivers, construction industry, and anywhere you can't work from home! Make no mistake, the impact will be felt across all industries!

At best we are expecting a 3 months slowdown. At worst, it could be a prolonged and deep negative impact on the economy. What we are sure of now, is that we are seriously looking at a looming recession.

In times like these, there is only one winner : CASH! You need funds, to ensure you swim through this slump, and come out a survivor!

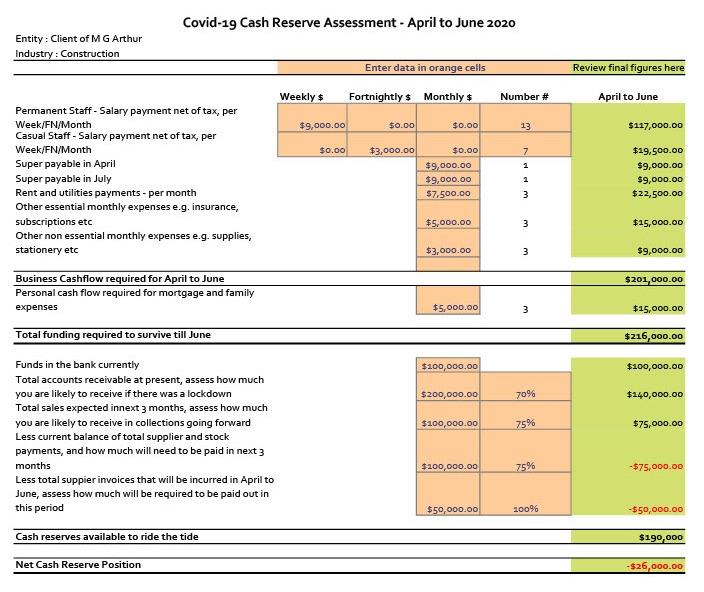

To assist, we have put together a simple spreadsheet. Click on the image below to download your copy. We strongly recommend you to work through the worksheet to assess your cash reserve position.

As our valued client, we will be happy to assist you in working out your Cash Reserve Position so you can make informed decisions.

COVID SURVIVAL ACTION POINTS

1. Assess your cash reserves using the above spreadsheet. Identify areas of savings. We are here to help you make informed decisions.

2. Series of stimulus are being released by the government and banks. Contact us so we can assist you to understand how these stimuli work, and how to maximise your benefit.

3. Consider delaying ATO payments for GST and PAYG. ATO has indicated they will have a co-operative approach to interest free extensions. Remember though, that ATO bills will have to be paid, albeit down the line. Also, super payments can not be delayed due to legislative restrictions.

4. Watch out for bank stimulus and repayment deferrals. Relief for small businesses and families are being released, and more is expected. Get in touch with your business bankers, to get regular updates.

5. Review your insurances. Some very critical insurances can still be organised, as per below. Contact us if you need a suitable professional to assist you in this area.

a) Trade credit insurance – so your business can get paid in case your customers are unable to pay

b) Business continuity insurance – to pay your business expenses if there is a total lock down or other business interruption

c) Enduring power of attorney – to ensure you have appointed someone to take up legal responsibilities of your business and financial decisions in case you fall seriously sick

6. Consider if some of your staff could go on leave, preferably unpaid leave. After all, it is better to be on leave, than lose your job. Ultimately take care of yourself, your family, and your workers first.

Lastly, do not loose sight of the light at the end of this tunnel. Things will change for better, perhaps sooner than we expect. Be ready to ride the wave, when low tide turns into high tide.

Join MGAA's Community