If you are a Director, including Director of a Trustee Company of a Family Trust or SMSF, Get your DIN

As part of modernising the Business Registers Program, Australian Business Registry Services have introduced Director ID or Director Identification Number (DIN). This is a mandatory requirement for all directors. It is a 15 digit identifier given to a director and applies forever, even though you may no longer be a director for a company, change your name, or move interstate or overseas.

Why DIN?

To prevent the use of fake director identities, eliminate director involvement in unlawful activities such as illegal phoenix activity and to make it easier for government regulators to trace directors' relationships with companies over time.

Who needs one?

All current and future directors, including alternate directors (acting in the capacity of) will need a DIN. You don't need one if you're a company secretary (but not a director), a sole trader or running a business in a partnership. For a complete list of who needs and who doesn't need a DIN, click here. You need a Director Identification Number DIN if you are a director or an alternate director who is acting in that capacity for a;

- company,

- trustee company of a trust

- trustee company of a superfund

Non-compliance is a criminal offence and may lead to fines and jail time of up to 12 months.

Exclusion

ABRS has released a draft legislative to exclude persons who have resigned as a director or alternative 'director acting in that capacity’ prior to 1 December 2022 from the obligation to apply for a DIN. While this legislative remains draft, ATO has stated directors who have recently resigned from their director roles are not expected to apply for a DIN.

Can the Tax Agent apply for a Director ID for their client?

No. The directors must do it themselves, as the Registrar will need to verify their identity. No one can apply on your behalf.

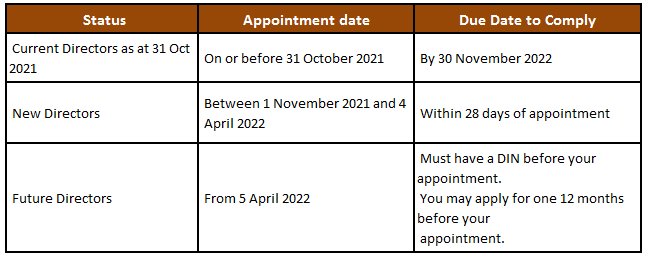

When to apply?

TIP : If you're already a Director prior to 31 October 2021 and become a Director of a new company between 1 November 2021 and 4 April 2022, you will need to get your DIN within 28 days of your new appointment.

There are 3 ways to apply;

Apply Online

- Set up your myGovID with a standard or strong identify strength.

To do this, you will need to download myGovID app and establish your identify. Click here for more information on setting up myGovID.

- Gather some information that ATO knows about you, for example TFN, residential address held by ATO, information from 2 documents to verify your identity, which includes

- Bank account details – enter the bank account details that ATO holds

- An ATO notice of Assessment – you'll need the date of issue and 'ATO - Our reference number'

- Super account details

- A dividend statement

- A Centrelink payment summary

- A PAYG payment summary

TIP : Residential address must match with ATO records. Contact us to check and update your details with ATO.

- Complete your application online at the ABRS website (it only takes about 5 mins).

Your DIN will not be posted, so print or save the PDF confirmation.

Apply via phone

- Phone 13 62 50

- Select option 1 from the automated system

- Provide operator with the following information about yourself;

- TFN

- Full name

- Date of birth

- Residential address as held by ATO

- 2 identity documents – one primary** and one secondary***

- Once the operator generates your DIN, record it.

- Provide your DIN to us

Apply via paper

- Phone 13 62 50 to arrange for the form. Click here for more information

- You will need to provide ATO with certified copies of your identity documents.

Call Australian Business Registry Services (ABRS) on 13 62 50 if you need help

** Primary Documents **

- Australian full birth certificate

- Australian passport

- Australian citizenship certificate or extract from a Register of Citizenship by Descent

- ImmiCard

- Visa (if you are using a foreign passport but you are still in Australia)

*** Secondary documents ***

- Medicare card

- Australian driver’s license or learner’s permit

What's next?

a) Provide Director ID to the company secretary and your tax / ASIC Agent to keep on file.

b) You may log on to abrs.gov.au to check or retrieve your Director ID information, view things to do, action in progress and past activity and edit your profile preference.

c) You must update your records on ABRS online within 7 days of change to your personal details. Inform us of the same, so we can also update ASIC.

d) In future, you will also be able to see companies you're linked to. There is currently no historical data available.

What happens if you don't apply for a Director ID?

Noncompliance is a criminal offence and may lead to fines and jail time of up to 12 months. ASIC is responsible for enforcing director ID offences set out in the Corporations Act 2001; which includes

a) Failure to have a director ID when required to do so

b) Failure to apply for a director ID when directed by the Registrar

c) Applying for multiple director IDs

d) Misrepresenting director ID

Should you need any further assistance or clarification on this matter, please don't hesitate to contact us.

Join MGAA's Community